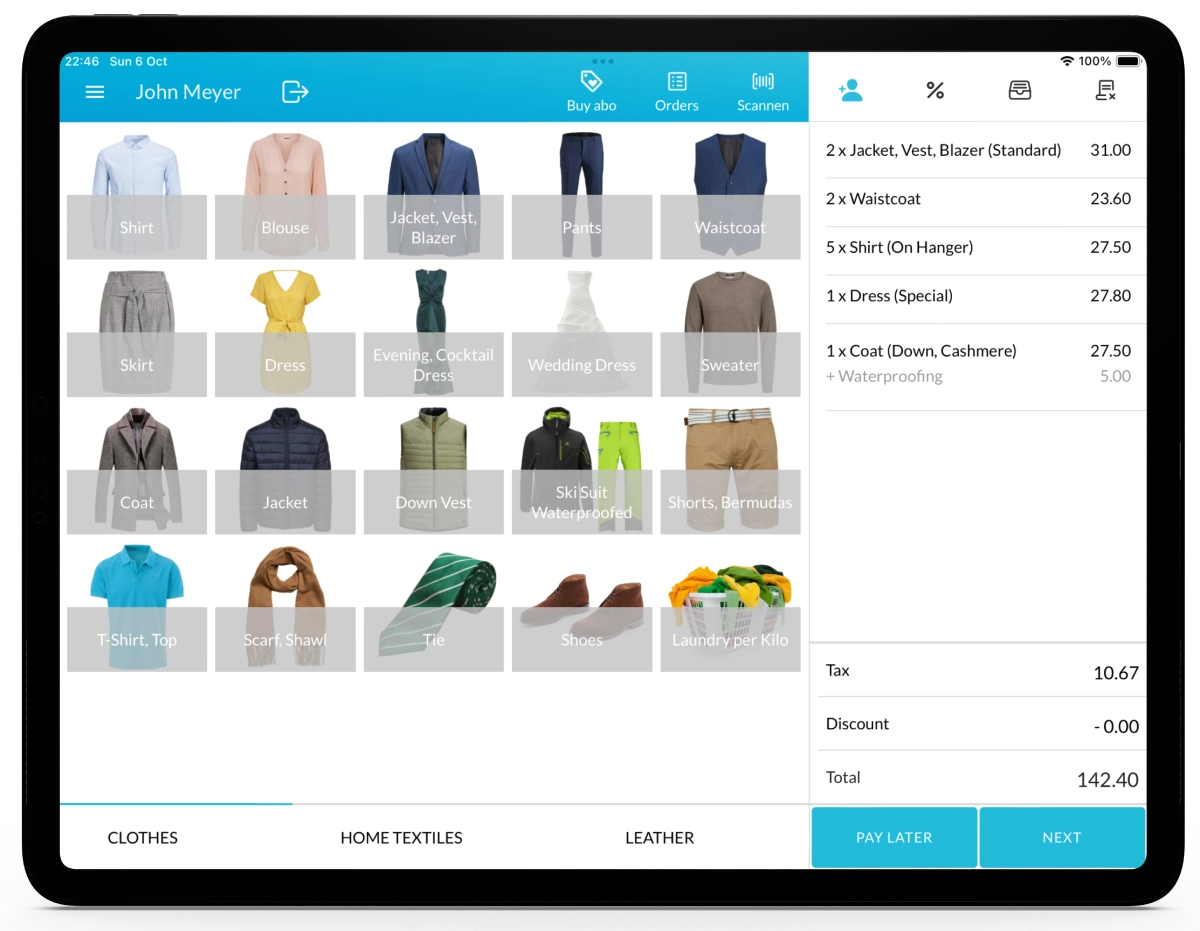

In Lagutta, you can define and manage Tax or VAT rates that apply to your items, services, or subscriptions, depending on your country or regional requirements.

Once created, these rates can be assigned to specific items, services, or subscriptions (Abos), ensuring accurate pricing and proper tax reporting.

Step-by-Step Guide to Adding a Tax / VAT

1. Log in to Lagutta Back Office

2. Navigate to Taxes

In the left-hand navigation menu, go to Settings and select Taxes.

Here, you’ll see a list of all existing taxes.

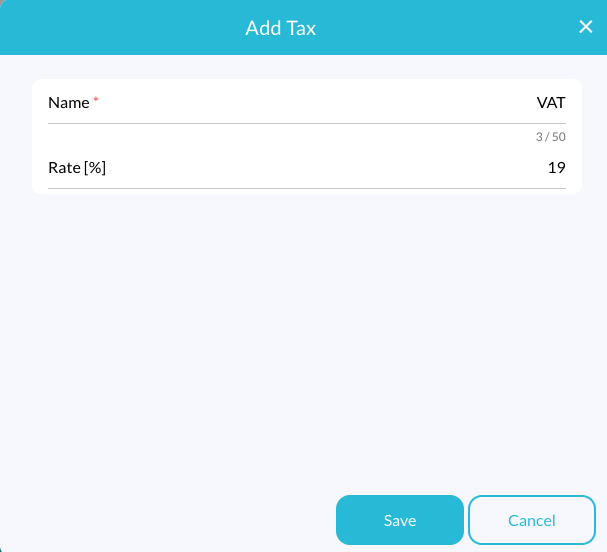

3. Add a New Tax / VAT

Click the + Add button to create a new tax or VAT entry.

A configuration window will open.

Configure the following fields:

- Name: Enter a name for the tax (e.g., “VAT”, “Reduced VAT”).

- Rate %: Enter the tax rate as a percentage (e.g., “19”).

4. Save Changes

Once you’ve configured the Tax/VAT, click Save to create it.

Now, whenever you add or edit an item or a subscription (Abo), the newly created Tax/VAT will be available to select in the VAT Settings section. (Learn How to Add and Configure Items or Services)